Hello, my name is Benjamin Hard. I'm an American attorney and the managing director of Integrity Legal here in Bangkok, Thailand. In this video today, as the title suggests, we're discussing I-601 waivers. For those who are unaware of what an I-601 waiver is, there's another video on this channel. In fact, multiple other videos on this channel discussing I-601 waivers at some length. Suffice it to say, an I-601 waiver is utilized by those who are found to be inadmissible to the United States under one of the legal grounds of inadmissibility listed in the Immigration and Nationality Act. And if found inadmissible, one of the only real remedies for that inadmissibility is the use of a waiver. In most cases, it's an I-601 waiver. There are certain circumstances where what's called an I-212 may be necessary, but in most cases, a simple I-601 is what's needed to go ahead and overcome that inadmissibility. So basically, this week we got an approval on an I-601 waiver, and I was thinking about it after I had looked over the approval notice. I thought to myself, we need to do a video about what happens after an I-601 waiver is approved. We discuss a lot about I-601 waivers with respect to what they're needed for and the reasons and findings of inadmissibility that they're associated with. But I never really thought about it. We haven't really done a video about what happens if they do get approved. I think there's a common misconception out there that upon approval of an I-601, the visa is sort of just magically issued. That's not the case at all. I-601 waivers, especially in cases where the applicant is applying outside of the United States for their visa, are kind of a reversion, if you will, to an...

Award-winning PDF software

601a waiver approved what's next Form: What You Should Know

This notice is the IRS's warning that they are levying your wages (or any wages on which they can make a withholding claim) using Form 668–W (or in some cases Form 668–W(CS). This notice tells your employer how much money (or wages) they will be able to withhold from your pay (or any wages on which they can make a withholding claim) and where you can receive the money. It also instructs you (employee) how to respond to your IRS return for any portion of the tax you did not pay. The notice requires you to have any wages or amounts withheld on the Form 668–W or Form 668–W(CS) sent directly to the IRS. However, you may give or keep this notice in your control as necessary by making electronic filing (File/Online E-File). As part of completing your tax-return, you provide the IRS with your employer's name, address, and TIN. You do not have to file Form 1040 on Form 1040A. The IRS will only need Form 1040–NR if the wages can be linked to taxable income and if the tax liability is substantially more than the wages. If you file the Form 668–W (or the Form 668–W(CS)) online, you cannot be required to have any information about your employee on Form 1040. Therefore, do not send Form 668–W or Form 668–W(CS) through e-file. Form 886, Notice to Employee (or an Executor, Personal Representative, etc.) of Wages, Salary or Earnings You can receive an IRS Form 886 by mail. Form 886 is a letter from the IRS that tells your employee that they are being placed into IRS collection. You also must have the amount of your wage or money withheld (as described in the notice, which could also be the form 668–W). The form 886 is for employees who are to be put into IRS collection. It tells them to mail in their TIN to the IRS, indicating that you are the payer. The letter says that you will send the amount of money withheld back to them in six months or less, according to current IRS guidance. The letter also says they're getting their TIN by mail.

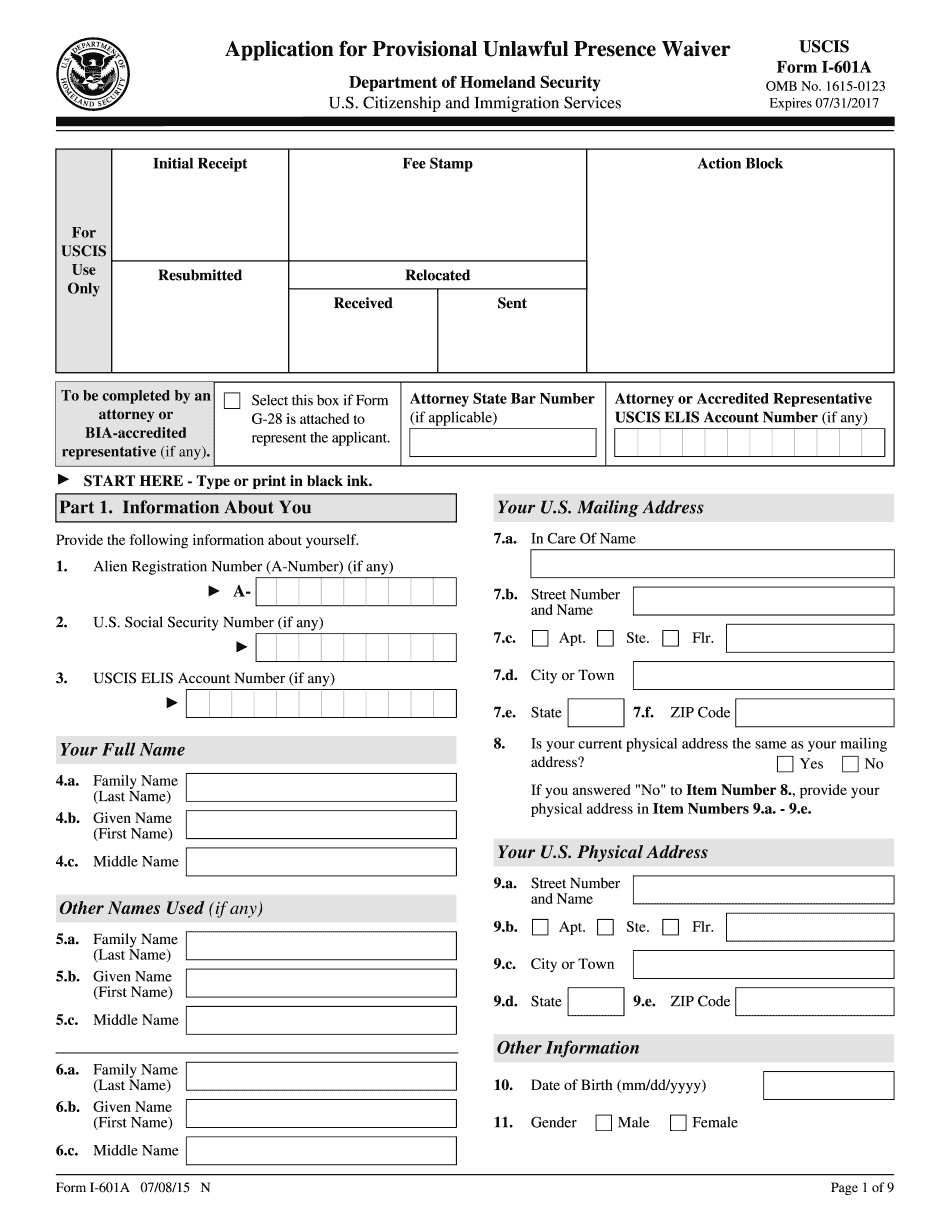

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form I-601a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form I-601a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form I-601a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form I-601a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 601a waiver approved what's next