Hey guys, in this video, I'm gonna talk about, um, the I 6 0 1 a waiver. I'm gonna answer a question from one of you on McBean immigration TV about this waiver. The question comes from, um, K R LS, Noah. And he says this, that he has a biometric appointment coming up for the I 6 0 1, a waiver, and he wants to know how long it's gonna take for them to make a decision on his I 6 0 1, a waiver. And that's a great question for those of you who are new to the whole I 6 0 1 a or any of the waivers. This is the waiver that need to be filed for those who have overstay their visa, or they entered without inspection. And consequently, they're not able to adjust their status in the United States. They have to go overseas back home to be interviewed at an embassy abroad or, um, count us consulate abroad. And so in this case with the I 6 0 1, a waiver provisional waiver for unlawful present, what it does is that it prevents the person from being barred, from return into the United States, based on the issue that they they've overstay, or they have unlawful present. So the way it works is this. If you had overstay in, uh, the us for over a certain period of time, you might be barred for either three years or 10 years from returning. And you file this waiver before you leave the United States, because the waiver attaches to you at the time that, you know, you lift off in that airplane and then the clock starts ticking as it relates to how soon you can return. Now, with this waiver, it allows you to leave and not be barred from coming back for the reason of the unlawful presence....

PDF editing your way

Complete or edit your amazon anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export uscis 601a directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 2015 form i 601a as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your form i 601a filling out by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

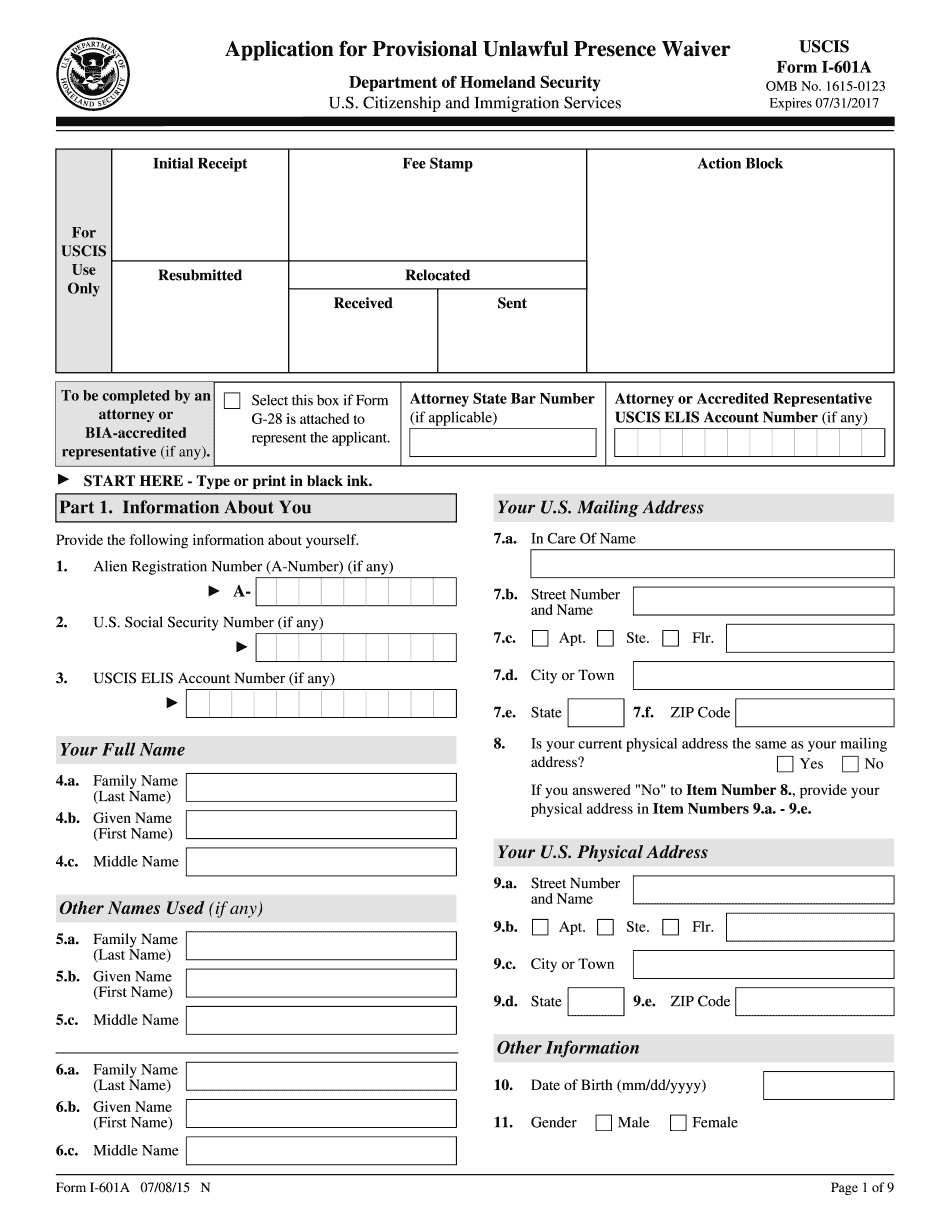

What you should know about Application Unlawful

- Form I-601A is also known as Application for Provisional Unlawful Presence Waiver.

- The form expires on 07/31/2017.

- It requires detailed information about extreme hardship faced by qualifying relatives.

Award-winning PDF software

How to prepare Application Unlawful

About Form I-601A

Form I-601A, also known as the Application for Provisional Unlawful Presence Waiver, is a form that certain individuals need to file to request a waiver for the unlawful presence ground of inadmissibility. This form is specific to individuals who are residing in the United States unlawfully and have accrued a certain period of unlawful presence, making them ineligible to apply for an immigrant visa or adjustment of status. The I-601A waiver is designed for immediate relatives of U.S. citizens (spouses, parents, and unmarried children under 21 years old) who are eligible for an immigrant visa but would trigger a three or ten-year bar upon leaving the country to attend their consular interview abroad. Instead of risking separation from their U.S. citizen family members during the visa application process, applicants can file Form I-601A to request a provisional waiver that would forgive their unlawful presence and potentially allow them to avoid the visa ban and subsequent family separation. By submitting this form and proving extreme hardship to their U.S. citizen spouse or parent, applicants demonstrate their level of hardship and the qualifying relationship to request the waiver. If approved, they can then attend their consular interview knowing that they have a provisional waiver in hand, thus minimizing the time spent apart from their family members in the United States. It is important to note that only those who meet the specific eligibility criteria can file Form I-601A and pursue an unlawful presence waiver. Additionally, filing this form does not guarantee approval, and it is crucial to consult with an immigration attorney or authorized representative to ensure the correct filing process.

People also ask about Application Unlawful

What people say about us

Complicated document management, simplified

Video instructions and help with filling out and completing Application Unlawful